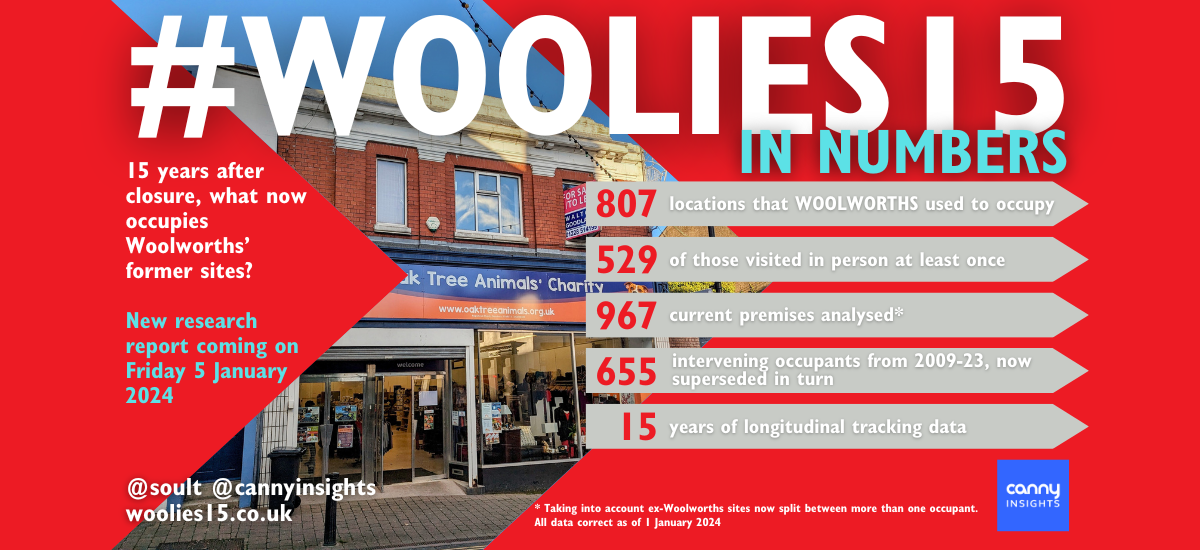

Exactly fifteen years after the closure of Woolworths, a new “#Woolies15” research report shows that more than four fifths of former Woolworths premises are still in active retail use – but the growth in non-retail uses, including leisure and housing, is the big trend compared to the #Woolies10 findings five years ago.

Woolworths was a fixture of British high streets for nearly 100 years, with its first UK store opening in Liverpool on 5 November 1909.

When no rescuer was found after the chain collapsed into administration on 26 November 2008, all 807 stores closed by 6 January 2009, with the loss of 27,000 jobs.

After Woolworths closed, Graham Soult, who runs the Gateshead-based retail consultancy CannyInsights.com, identified the 807 premises across the UK from which the business was trading immediately prior to its collapse.

Over 15 years, he has tracked subsequent occupants of these premises using a combination of his own site visits and detailed desk research. Each location’s status was most recently checked between September and December 2023.

Over the course of the 15 years, Graham has visited 529 of the 807 ex-Woolworths locations in person at least once – and many of them multiple times!

The research shows that:

- The vast majority of the 807 former Woolworths premises – 672 (83%) – remain entirely (627) or partly (45) in active use by other retailers, though this is down from 738 (91%) five years ago.

- About 40% of ex-Woolworths sites (324) house variety stores, like Poundland, B&M or Poundstretcher – so, retailers whose offer is similar to that previously provided by Woolworths.

- More than one in five Woolworths sites (176) now accommodate a grocery or convenience store, such as Iceland, Heron Foods, Tesco or Sainsbury’s – exactly the same number as in 2019.

- Reflecting wider high street trends, the number of fashion stores in ex-Woolworths premises has fallen sharply from 124 in 2019 to 91 now.

- Indies are growing – 107 sites now house at least one small independent business, up from just 72 in 2019.

- The biggest single current occupant of ex-Woolworths sites, by far, is still Poundland with 134 – around a sixth of the estate. Iceland is next, with 71.

- At least 101 former Woolworths properties (13%) have been permanently subdivided to accommodate more than one new occupant, up from 89 in 2019.

- The number of ex-Woolworths sites in non-retail use has more than doubled in the last five years. Our research has identified 48 locations (6%) that are now wholly in non-retail use – up from 22 in 2019 – and another 50 that are non-retail in part (up from 23).

- Since 2019, non-retail uses have become increasingly diverse – especially around leisure and gaming. Eye-catching subsequent additions include the impressive Migration Museum in the old H&M at Lewisham Shopping Centre; virtual reality experience Sandbox VR replacing fashion chain Select at Birmingham’s Grand Central; “booze and ball games” venue Roxy Lanes opening in Cheltenham’s former New Look; and wizard golf attraction The Hole in Wand taking part of an ex-Poundland in Blackpool.

- Types of non-retail uses highlighted in our 2019 report – and that have continued to see growth since then – include pubs, bars and restaurants (18), coffee shops (14), gyms (13), offices (eight), education and training (five), libraries (three), health centres (three), and dentists (three). There is also still an accountant, a function room, and a nursery.

- There has been a substantial increase in housing developments within former Woolworths locations. Our research has identified 18 ex-Woolworths sites (2%) already with a residential element – up from just five in 2019 – with at least 11 more planned.

- 74 ex-Woolworths sites (9%) are fully vacant, almost all after previously being occupied. This is a notable increase on the 43 we recorded in 2019 and the 22 in 2014, but is well below the widely cited vacancy rate for UK high streets as a whole (just under 14%).

- Nearly a third of these fully vacant sites – 22 – are former Wilko (14) or M&Co (eight) stores that were only vacated in 2023 and have not been refilled yet.

- However, among what were once Woolworths sites, 12 ex-M&Co units and nine former Wilkos are already occupied again, demonstrating strong demand.

- Churn is a major factor – there are now 417 ex- Woolworths locations (52%) where the present occupants are different to those who took over the premises originally following Woolworths’ closure – up from just 294 in 2019.

- On the other hand, it means that in 390 locations (48%), the business that moved in immediately after Woolworths’ collapse 15 years ago is still trading there – a surprising degree of stability.

- The number of demolished Woolworths stores now stands at 18 (2%), with at least another four in the pipeline. Though still relatively few, it represents a notable increase from the mere six recorded in 2019.

Commenting on the findings, Graham Soult said:

“It’s telling that even 15 years on, people are still interested in talking about Woolworths, and it’s often named as the retailer that consumers would most like to bring back from the dead.

“When Woolworths closed, we didn’t just lose a store – we lost a source of comfort, and of familiarity across generations, that helped to underpin our sense of place and belonging.

“That’s why people do care about what those former Woolworths sites have become.

“Overall, it’s encouraging that the findings paint a more positive picture of the high street than many might be expecting, despite the myriad of challenges that both businesses and consumers face.

“Against that backdrop, it is remarkable that more than four fifths of ex-Woolworths sites still remain in active retail use, some 15 years later. As a well-known champion of the high street, I’m proud that this report helps shine a light on so many success stories.

“Nevertheless, the scale of change taking place on the high street, which was already apparent five years ago, is only going to accelerate. This will present challenges, as it always has done, but also exciting opportunities to reinvent and improve our places.

“While retail is, and will remain, an important feature of the high street, our local, town and city centres are increasingly becoming about more than just shopping – and the ex-Woolworths estate offers a rich and insightful snapshot of those trends.

“Tracking the changes that have happened in these locations over the last 15 years is like holding up a magnifying glass to the high street as a whole.

“We can see how agile, well-run retail businesses that give customers a great experience, and the products and services they want – whether those are national chains or, increasingly, independents – will continue to do well, even as they navigate the inevitable challenges.

“In parallel, the evident growing trend for much more diverse high-street uses – including leisure, healthcare, education, and, certainly, housing – is fascinating.

“The boring, mono-use clone town may be a thing of the past – but local, distinctive, diverse high streets are much more alive than we give them credit for.”

The full report is available to download for free here.