High-street audit

In February 2014, we undertook a high-street audit for Chester-le-Street Business Association.

The work included recording uses and vacancy rates across Chester-le-Street town centre, and preparing a presentation/report that proposed areas for improvement and action.

Key findings

Vacancy and uses

- We logged and photographed 257 town-centre premises in Front Street and the surrounding area, of which 110 were identified as shops (i.e. selling products), 105 as other retailers or services, 21 as leisure (pubs, restaurants), and 21 as non-retail.

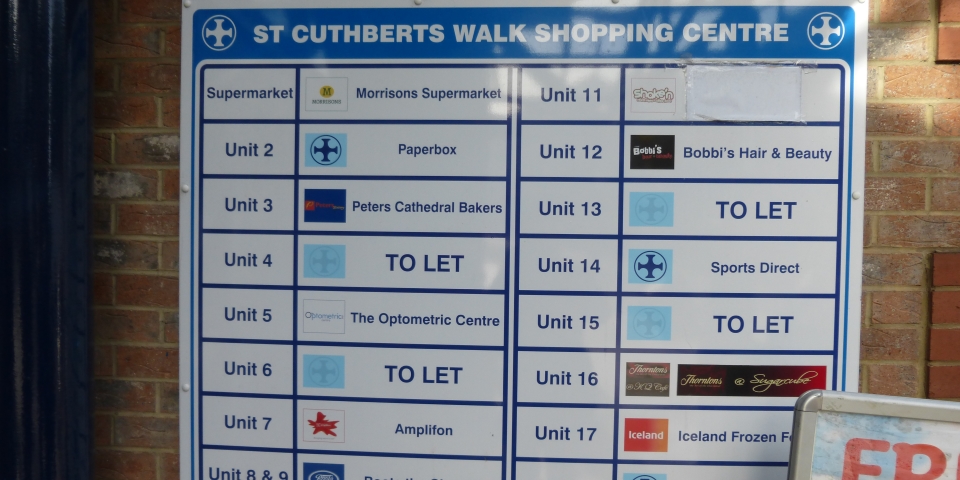

- The report identified 28 vacant units out of the 236 retail/leisure premises across the town centre – at 11.8%, a rate lower than the UK average at the time. A major hotspot was St Cuthbert’s Walk shopping centre, where six of the 17 units were empty (a 35% vacancy rate), with another shop closing down.

- Out of 187 trading shops/services in Chester-le-Street, 65% were independent businesses, demonstrating the importance of these local retailers to Chester-le-Street town centre.

- The number of charity shops – nine (5% of occupied shop premises) – was relatively low.

Positives and negatives

Having visited the town centre on a Friday lunchtime, the report summarised several positive aspects about Chester-le-Street, including:

- A surprisingly strong and diverse indie retail offer

- Key big-name retailers remaining in the town

- A relatively lively high street in terms of footfall and activity

- A strong market heritage

- Car parks that were nearly full.

At the same time, negatives highlighted by the high-street audit included:

- A predominance of large empty units, making the vacancy problem appear worse than the headline rate would suggest

- Departing multiples, such as Semichem and Magnet, creating an issue of blight

- An underwhelming outdoor market

- Evidence of a lack of nighttime economy/activity, with only six restaurants

- Problems with the retail mix, with 19 hairdressers but only two fashion retailers

- Poor or limited promotion of the Chester-le-Street offer, both in town and online.

Actions

The report proposed actions under a series of key headlines, including:

1. Collaborate and promote

Arguing that Chester-le-Street’s independents were distinctive, and a reason to visit, but that the town was almost invisible online, the report suggested:

- Developing a town-wide loyalty card initiative

- Relaunching the Chester-le-Street Business Association website (and ideally adding social media)

- Building up an inflow of independents by encouraging new market stallholders.

2. Enhance in-town messaging

Highlighting some of the out-of-date signage and information around the town, the report proposed:

- Reminding those responsible for posters/signage to ensure that information was kept tidy and up-to-date

- Helping retailers enhance their kerb appeal, by addressing the questions of: What appeals to the customer? What puts them off? What attracts them? What acts as a barrier to them coming in?

3. Maximise use of car parks

The report noted that because Chester-le-Street’s car parks were already busy at peak times, there was limited room for manoeuvre in reducing charges. However, while parking charges were relatively low, the variation in car park tariffs across the town could be confusing.

The report therefore suggested:

- Lobbying for free parking at quieter times – e.g. late afternoon

- Addressing inconsistencies in the charges levied

- Potentially undertaking further research into car-park use in Chester-le-Street.

4. Address empty shops issue

Our presentation noted that while there was not much that could be done locally about rents or business rates, it was a fact that empty shops were having a negative impact on Chester-le-Street as a destination, and on perceptions of the town.

Potential actions that we proposed were therefore:

- Applying Shopjackets or other artwork to boarded-up shops

- Creating pop-up shops or window displays.

Desired outcomes – and actual impacts, three years on

Market Hall Shops and Cestrian Estates

By addressing the four headline areas for action, as set out above, we argued that the desired outcomes would be:

- More people knowing about what Chester-le-Street (already) offers

- A town that is easier to park in and navigate, and that looks more attractive

- Increased awareness leading to increased footfall, a livelier market, fewer empty shops, and more evening activity.

In April 2017, as a direct result of a relationship established through this earlier project, we began working with one of Chester-le-Street’s biggest commercial property companies, Cestrian Estates. Based locally, this business owns and manages the Market Hall Shops shopping arcade (ex-InShops) but is also the landlord of many other retail premises in Front Street. You can read more about this current project here.

This ongoing work is focussed on addressing many of the issues highlighted three years earlier, including supporting and championing independent retailers, filling empty units, improving the appearance of the town centre, and, through Twitter, Facebook and Instagram accounts for Market Hall Shops (@MarketHallCleS), greatly enhancing the extent of Chester-le-Street’s positive messaging and visibility online.

First time seeing the decorated planters at @MarketHallCleS after dark. Adding a welcome splash of joy and sparkle to #ChesterleStreet! pic.twitter.com/R18yUIr6qu

— Graham Soult FIPM (@soult) November 7, 2017

Indeed, in October 2017, WDYT’s Digital Influence Index – which measures Twitter and Instagram activity by retailers in 1,300 UK towns and cities – reported that Chester-le-Street had risen 70 places during 2017, to be ranked at 449. As more town-centre shops become Twitter active, we hope this can grow further.

You were ranked 449 yesterday: but good news you’ve risen 70 places this year! More info here https://t.co/6S3mIwTp8s #WDYT

— JoinWDYT (@JoinWDYT) October 24, 2017

Elsewhere, the last three years have seen Chester-le-Street Business Association revamp its website and establish its presence on Twitter and Facebook, sharing useful updates about events and the town’s businesses.

In terms of parking, there has been some action of late. For instance, tickets became transferable between council-run car parks in Chester-le-Street from December 2017, and Durham County Council has experimented with ‘free after 3’ parking in the run-up to Christmas – though our personal view is that we’d like to see this initiative rolled out all year round, permanently.

Pleasingly, almost all the most prominent empty units on Front Street also now have new or pop-up occupants.

St Cuthbert’s Walk

Of all the parts of Chester-le-Street town centre, the 60,000 sq ft St Cuthbert’s Walk shopping centre – despite being a key route linking the Front Street with Morrisons and Iceland – has remained most problematic.

Nevertheless, Shoe Zone was a welcome new arrival in March 2017, filling a Front Street-facing unit that had been empty for several years.

It's good to see a new branch of @Shoezone open in #ChesterleStreet. This prominent unit on Front Street has been empty for years! pic.twitter.com/37pqyZYDyb

— Graham Soult FIPM (@soult) March 27, 2017

Available units within the scheme are generally quite small (less than 2,000 sq ft), but rents advertised by Bradley Hall within the centre do not appear significantly different, per square foot, to comparable premises currently offered on the Front Street. Rather, it is the business rates that seem to be one of the biggest barriers to occupancy.

Assessing the opportunities and limitations around St Cuthbert’s Walk, we argued in November 2017 that:

Though Front Street has the benefit of better visibility (including many passing buses) and a general buzz that the shopping centre lacks, the desolate feel of St Cuthbert’s Walk seems to be more a function of so many empty units, rather than any lack of footfall.

So, the potential is there – but redevelopment of St Cuthbert’s Walk to create larger and more desirable modern units, which Front Street has few of, may be the only sensible long-term solution.

It would also be useful for St Cuthbert’s Walk to address its own lack of brand personality, and poor visibility online. It is almost unheard of these days for any shopping centre of any size to have no customer-facing website or social media presence at all, but that appears to be the case here.

Happily, on the back of our work for Cestrian Estates and Market Hall Shops, Bradley Hall commissioned us in January 2018 to carry out similar work with St Cuthbert’s Walk, to address the lack of online presence.

What can you find inside St Cuthbert's Walk? Here's a quick taster… #ChesterleStreet @Shoezone @AmplifonUK @Morrisons @IcelandFoods pic.twitter.com/cRlReFbSFd

— St Cuthbert's Walk Shopping Centre (@stcuthbertswalk) February 20, 2018

This new project – which doubles the amount of time we have available to work in and promote Chester-le-Street – has involved setting up and managing @StCuthbertsWalk social media accounts, developing a website (to launch soon), and, like at Market Hall Shops, acting as a digital champion and mentor for the existing independent retailers in the mall. Again, you can read more about this work here.

Summary

Retailers in Market Hall Shops are regularly reporting customers saying that they heard about them on Facebook or Twitter, with tweets from @MarketHallCleS being seen an average of 17,000 times a month. Meanwhile, occupancy at Market Hall Shops has increased from 11 units, when we began working there in April 2017, to 20 units a year later.

Our work is at an earlier stage at St Cuthbert’s Walk, but feedback from the retailers is positive, and there is plenty of online engagement where previously there was none.

Hence, though Chester-le-Street has some stubborn issues still to address, the town, and how it is perceived, is certainly in better shape than it was four years ago, with greatly enhanced online visibility.

Last updated: 15 April 2018

Need insight and support to help your own town?

We can help you understand the strengths and weaknesses of your town or shopping centre, and identify practical actions to address those issues.

Get in touch if you’d like to have a chat.

1 Comment

[…] 2014 report on shop vacancies in Chester-le-Street […]